Our History

Since 1954, we have built a team unified by our values, our commitment to building shareholder value, and our culture, which empowers every employee to make decisions and achieve the company’s goals. Our global team is brought together by a sense of ownership and the knowledge that the best answers win. We strive to deliver shareholder returns while helping to fulfill global energy needs and developing innovative, more sustainable ways to operate. We aim to be a community partner in our areas of operation, focused on protecting the safety and health of our employees, communities and the environment.

1950s

-

1954

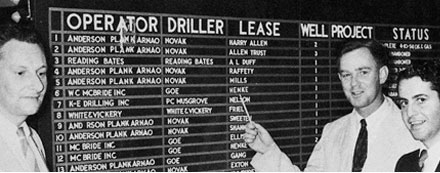

Apache Oil Corporation was founded Dec. 6, 1954, in Minneapolis by Truman Anderson, Raymond Plank and Charles Arnao. The company started with six employees and $250,000 in funding. The company’s name started with the founders’ initials – A, P, and A. “Che” was added to the end at the suggestion of Helen Johnson, an early employee who was awarded a $25 U.S. savings bond for the idea.

-

1955

Apache’s first wells were drilled in the Cushing Field in Cushing, Oklahoma. The first well only produced a whopping seven barrels per day. The second, the Bradley Rafferty No. 1, did a bit better, delivering 700 barrels daily. Apache’s first year in operation ended with a net income of $12,535 on revenue of $190,000.

-

1956

Apache was one of the first firms to register a drilling program with the U.S. Securities and Exchange Commission (SEC), providing investors with the protections of SEC reporting requirements and distinguishing the young company from the many sketchy patch promoters who peddled shady investments to naive investors.

1960s

-

1960

Plummeting oil prices induced Apache to start diversifying its investments. The company acquired interests in the Foshay Tower, a Minneapolis landmark. The 32-story building became Apache’s headquarters from the early 1960s until 1984. Over the next two decades, Apache also diversified into agriculture, steel, plastics, telephones, utilities, cattle and dude ranching, aerosol cans, lumber, auto supplies and other businesses — a total of 58 acquired firms.

-

1967

Apache established its reputation as an oil explorer in Wyoming’s Powder River Basin with its first major oil discovery, the Fagerness No. 1, near the town of Recluse. The discovery flowed 1,200 barrels of oil per day from the Muddy formation and was followed by 23 additional oil producers and two gas producers.

-

1969

Apache’s stock was listed on the New York Stock Exchange (NYSE), opening at $30.50 per share. Founder Raymond Plank bought the first 100 shares himself as a show of confidence.

1970s

-

1971

Apache formed Apache Exploration Company (Apexco) as its oil and gas operating company in 1971. The new company provided drilling program investors with an opportunity to gain liquidity and focused attention back to oil and gas. Within three years, Apexco lifted Apache to the $200 million mark and was hailed as one of the most ingenious corporate offsprings in the history of the petroleum industry.

-

1977

Apache sold Apexco to the Natomas Company for $127 million – the biggest single transaction Apache had ever made at the time. The proceeds were reinvested into a farm-in agreement with GHK to operate its wells in the Anadarko Basin. Within three years, the value of Apache shares on the NYSE rose from $50 million to $0.5 billion aggregate worth.

1980s

-

1981

Apache created a new investment vehicle to benefit investors in 1981, when its many drilling partnerships were consolidated into Apache Petroleum Company (APC), the first publicly traded master limited partnership (MLP). The new investment vehicle provided investors with the liquidity and opportunity for price appreciation of a stock and the tax advantages of a partnership.

-

1987

After the global collapse of oil prices and a U.S. tax reform that diminished the tax advantages of limited partnerships, Apache restructured into a pure exploration and production company and moved its headquarters from Minneapolis to Denver.

1990s

-

1991

Apache doubled its reserves by acquiring assets from Amoco, including a position in one of the world’s largest oil provinces — the Permian Basin of West Texas and eastern New Mexico.

-

1992

Apache moved its corporate headquarters to Houston, the center of the global oil and gas industry.

-

1994

Apache began operations in Egypt by acquiring a 25% nonoperated interest in the Qarun Concession in Egypt’s Western Desert. The operator, Phoenix Resources, soon drilled a discovery that flowed 12,000 barrels per day.

-

1996

Apache merged with Phoenix Resources and took over Egypt operations. The merger also brought a 40% nonoperated interest in the much larger Khalda-area concessions, then operated by Repsol, the Spanish oil giant.

-

1997

Apache was added to the S&P 500.

2000s

-

2000

Apache acquired Repsol’s interests in Egypt’s Western Desert and operating control of the Khalda-area concessions. Aggressive operations and exploration turned the Western Desert into one of the company’s principal growth engines.

-

2002

Founder Raymond Plank passed the title of chief executive officer to Steven Farris, who retained the titles of president and chief operating officer. Mr. Plank remained the company’s chairman until his retirement in January 2009, 54 years after he established the company.

-

2003

Apache acquired the Forties field, the largest field ever discovered in the United Kingdom’s North Sea.

The Qasr discovery — a 2-trillion-cubic-foot resource in the Jurassic Lower Safa formation – triggers new growth in Egypt.

-

2008

In Egypt, the West Kalabsha C-1X was a critical Jurassic discovery in the Faghur Basin, testing at 4,746 barrels per day and 4.4 million cubic feet per day. It was followed by a larger discovery at Phiops 1X, leading to the westward expansion of Apache.

2010s

-

2010

Apache merged with Mariner Energy and acquired its assets in the Deepwater Gulf of Mexico and the Permian Basin. Apache also acquired assets from BP in the Permian Basin and Egypt.

-

2011

Apache became an early advocate for transparency in hydraulic fracturing operations and began posting the composition of its frac fluids at FracFocus.org, a joint venture of the Ground Water Protection Council and the Interstate Oil and Gas Compact Commission.

Apache expanded its holdings in the North Sea with the acquisition of ExxonMobil Corporation’s Mobil North Sea Limited assets. Apache assumed operations of the Beryl, Nevis, Ness, Nevis South, Skene, and Buckland fields, the Beryl/Brae gas pipeline, and the SAGE gas plant.

-

2013

Apache is the first to use natural gas to power hydraulic fracturing, which is one of the most energy-intensive processes employed by the industry. The company also deployed drilling rigs powered with natural gas.

-

2015

After more than 25 years at Apache, chairman, CEO, and president Steven Farris announced his retirement. John Christmann IV, an Apache veteran of 19 years and COO of North America, succeeded Mr. Farris as CEO and president.

-

2016

Apache announced the Alpine High discovery in the Delaware Basin.

-

2018

Apache created Altus Midstream Company and retains a majority stake and operational control.

-

2019

Apache announced a redesign of its organization structure and operations for the long term. Apache also announced a joint venture agreement with Total S.A. to explore and develop Block 58 offshore Suriname.

-

2020

Apache and partner, Total S.A., announced three discoveries in Block 58 offshore Suriname.

-

2021

The company announced the creation of APA Corporation, a holding company with Apache Corporation as one of its operating subsidiaries.